Salary Manager

La gestion des salaires au Luxembourg représente un enjeu stratégique pour les entreprises, en raison de la complexité des règles sociales et fiscales locales. Entre les cotisations sociales, la gestion des congés payés, des heures supplémentaires et l’indexation automatique des salaires, le respect des obligations légales est indispensable. Externaliser la gestion des salaires au Luxembourg permet non seulement de garantir la conformité réglementaire, mais aussi de simplifier les processus RH et d’optimiser la performance administrative de l’entreprise.

Why outsource payroll management?

L’externalisation de la paie présente de nombreux avantages pour les entreprises implantées au Grand-Duché :

- RConformité légale assurée

Respect de la législation luxembourgeoise, y compris l’indexation automatique des salaires.

- RGain de temps précieux

Libérez vos équipes RH de tâches administratives répétitives.

- RRéduction des risques d’erreurs

Gestion précise des cotisations sociales, impôts et avantages.

- RAccès à une expertise locale

Nos spécialistes maîtrisent parfaitement les spécificités du droit du travail luxembourgeois.

- ROutils digitaux sécurisés

Accès en ligne aux bulletins de paie et à l’historique des salariés.

What services do we offer?

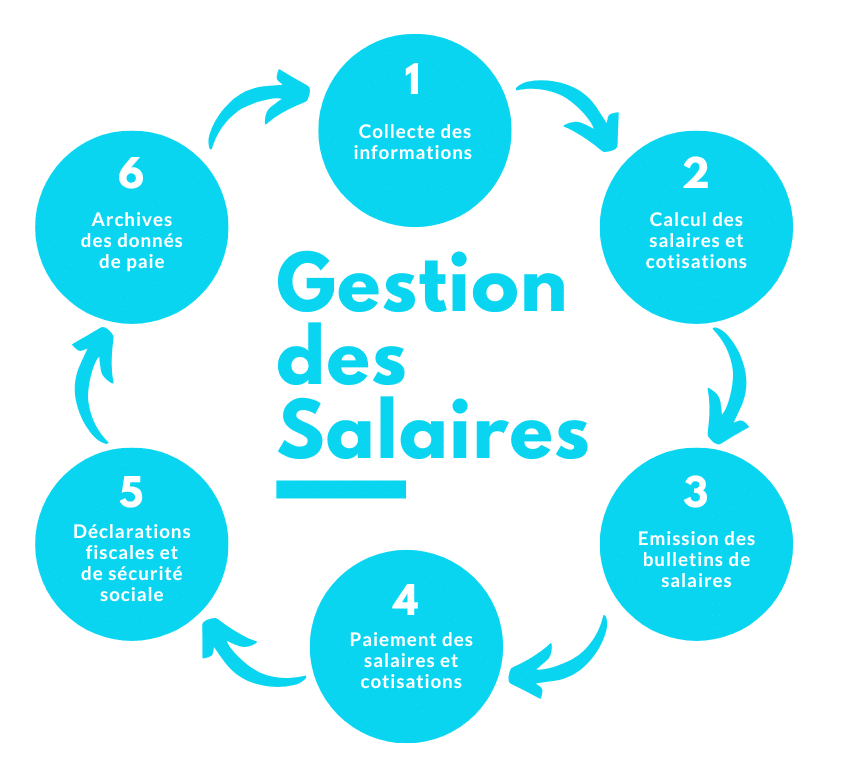

We offer a full range of payroll management services, including :

- The preparation of employment contracts of your employees

- Preparing and issuing pay slips for your employees, guaranteeing accurate salary calculations and tax and social security deductions;

- The preparation and filing returns tax and social security contributions;

- Management of social security contributions and income tax, to ensure that all legal obligations are met and that your employees receive their due net salary;

- The leave management and absences, ensuring efficient leave management and handling absences due to sickness, maternity, paternity and other statutory leave;

- Tracking hours worked and overtimeThis will ensure compliance with current legislation on working hours and pay;

- Handling exchanges with the tax authorities, by preparing and submitting tax and social security returns, responding to requests for information and handling tax audits;

- L'digital access to your employees' payslips, as well as a dedicated space for your company;

- Advice on social legislation.

Why choose us?

At Wat FiduciaryWe have a team of payroll experts with in-depth knowledge of Luxembourg laws and regulations. We can provide tailor-made payroll services to meet the specific needs of your business. Whether you are a small business or large companyWe have the skills to manage all aspects of your company's payroll effectively.

We also have solid experience in payroll management for international companies who wish to establish a presence in Luxembourg. We can effectively manage all payroll issues for multinational companies, including tax and social compliance.

Our team of payroll professionals is on hand to answer all your questions and help you manage your payroll effectively. We offer salary management services from high quality at competitive priceswith a commitment to excellence and customer satisfaction.

Contact us today to find out more about our payroll services and how we can help your business with these tasks.

Quels documents sont nécessaires pour externaliser la paie ?

Une copie du contrat de travail, les données d’identification du salarié, et les informations générales de la société suffisent pour débuter.

Est-ce que vous gérez les déclarations sociales ?

Oui, nous prenons en charge toutes les obligations mensuelles auprès du CCSS, ACD, et autres organismes.

Comment gérez-vous la confidentialité des données ?

Nos outils sont sécurisés avec chiffrement SSL et hébergement au Luxembourg, garantissant la confidentialité des données RH.